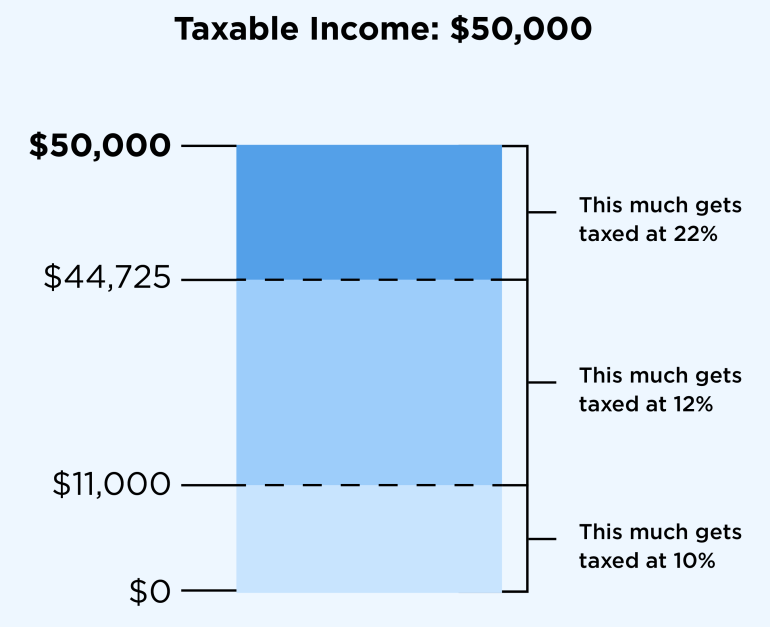

Tax Brackets 2024 Nerdwallet Calculation – and tax calculation instructions for each tax bracket. So, once you determine your expected 2024 filing status and taxable income, you can predict the tax bracket you’ll be in—and highest tax . There is a separate set of tax brackets and rates for long-term capital gains and qualified dividends. Investors who have taxable accounts—as opposed to tax-favored retirement accounts such as .

Tax Brackets 2024 Nerdwallet Calculation

Source : www.nerdwallet.com

2023 2024 Tax Brackets and Federal Income Tax Rates NerdWallet

Source : www.nerdwallet.com

W 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.com

Massachusetts State Income Tax: Rates and Who Pays in 2023 2024

Source : www.nerdwallet.com

50/30/20 Budget Calculator NerdWallet

Source : www.nerdwallet.com

IRS Announces 2024 Tax Brackets, Updated Standard Deduction

Source : www.nerdwallet.com

50/30/20 Budget Calculator NerdWallet

Source : www.nerdwallet.com

California Income Tax 2023 2024: Rates, Who Pays NerdWallet

Source : www.nerdwallet.com

NerdWallet Announces Winners of its 2024 Best Of Awards | Business

Source : www.businesswire.com

Fed Holds Rates Again. Expect Cuts in 2024 NerdWallet

Source : www.nerdwallet.com

Tax Brackets 2024 Nerdwallet Calculation 2023 2024 Tax Brackets and Federal Income Tax Rates NerdWallet: Your tax bill is largely determined by tax Siege A single person with $140,000 in taxable income in 2024 would be in the 24% tax bracket. This doesn’t mean all of their income is taxed . Both federal income tax brackets and the standard deduction have increased for 2024. This change is in response to sticky inflation, which has kept prices high all year. The higher amounts will .